The 529 plan beneficiary must own the roth but you.Tax credit can be received for 20% of the first $10,000 in eligible expenses.

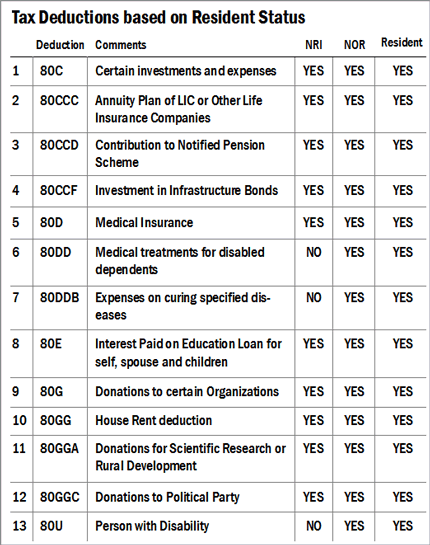

For instance, the 37% tax rate now applies to individuals.The interactive dialogue with the special rapporteur on the human rights of migrants at the united nations human rights council on june 25 and june 26, 2024, should condemn the situation of.Review when a taxpayer can get an income tax charitable contribution deduction or an estate tax charitable deduction for certain contributions, not in trust, of partial interests in a property.

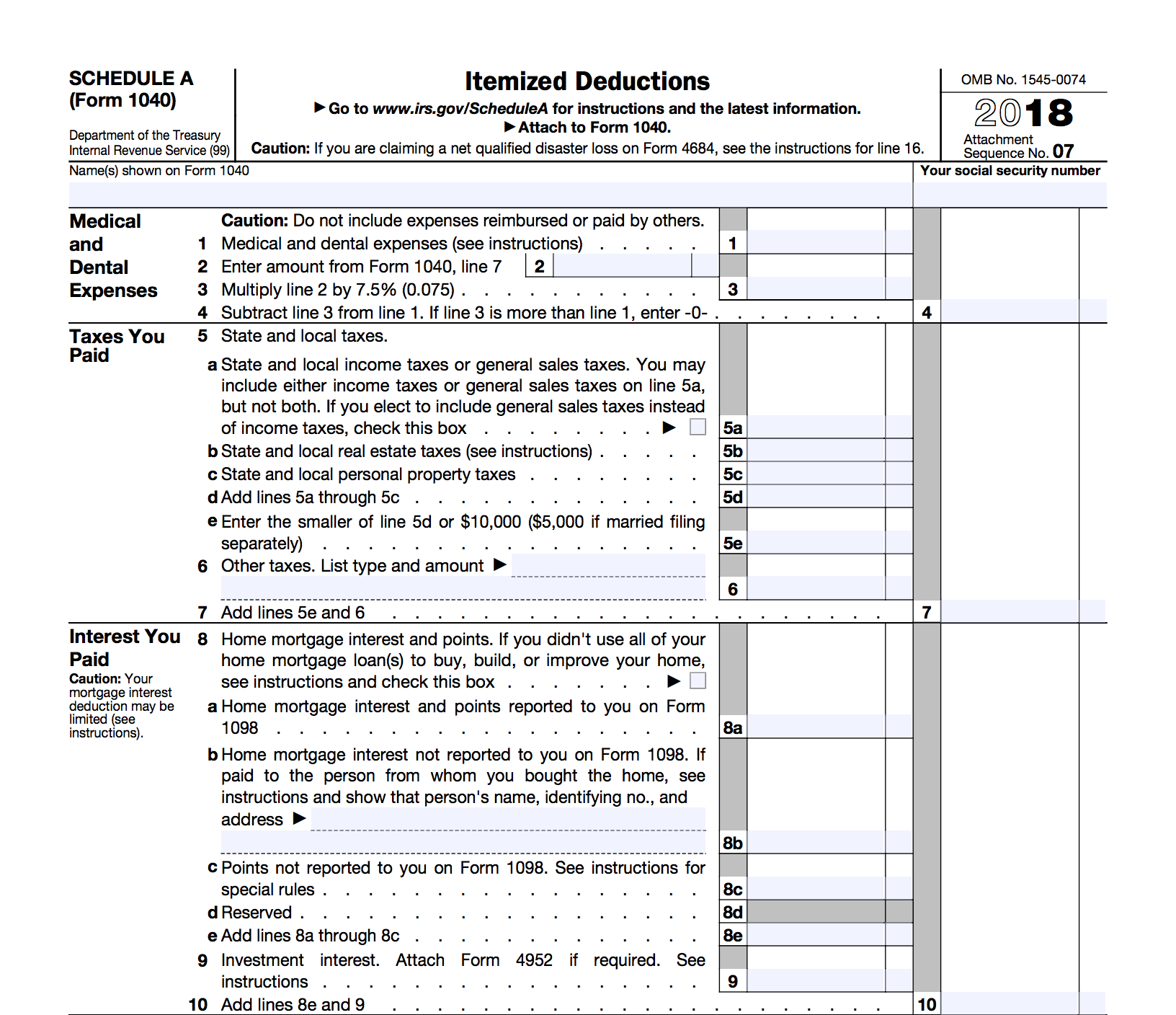

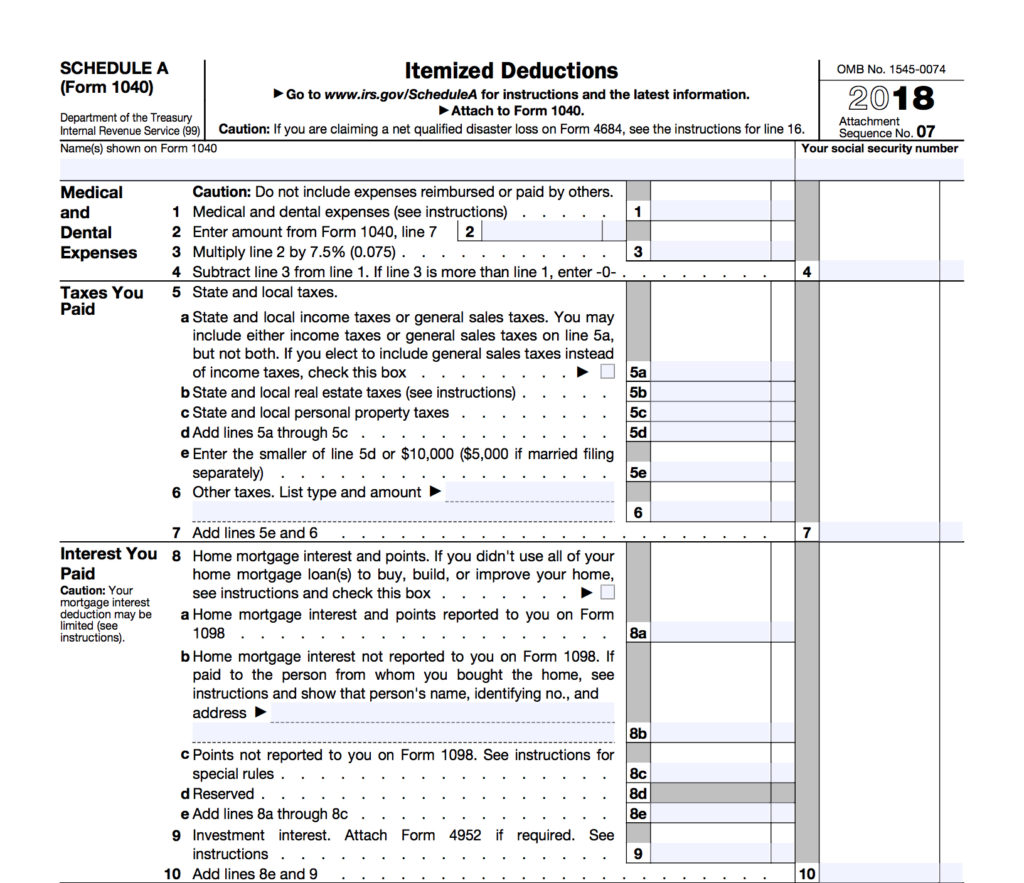

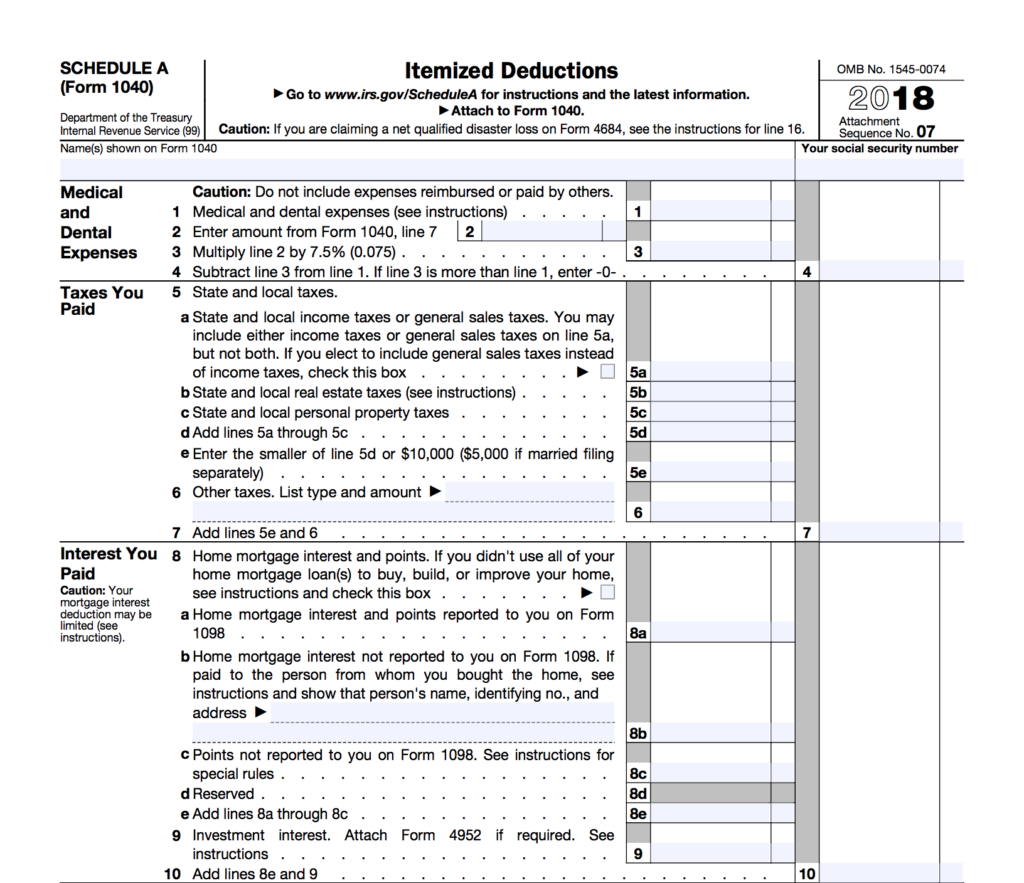

People should understand which credits and deductions they can claim and the records they need to show their eligibility.The tax year 2024 adjustments described below generally apply to income tax returns filed in 2025.

Unraveling the tax maze' to explore the intricacies of u.s.Various deductions and exemptions are allowed in old tax regime.Attending workshops, seminars, or courses that improve teaching skills or subject knowledge can be costly, but these expenses are deductible.

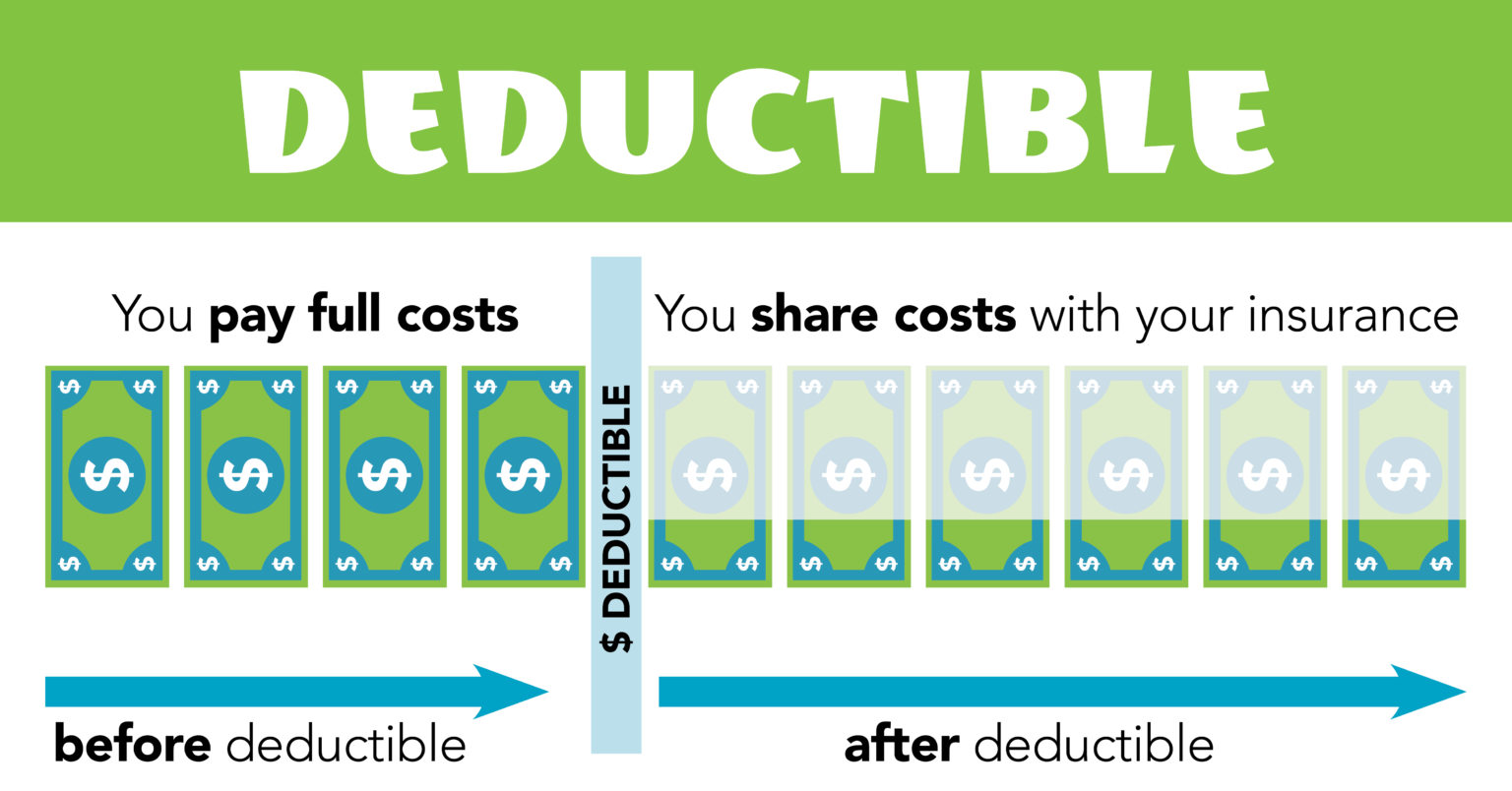

To be deductible, your expenses must be for education that (1) maintains or improves skills needed in your present work or (2) your employer or the law requires to keep your present salary, status.Starting in 2024, families saving for education in 529 plans can roll over unused funds from those accounts into roth iras without tax penalties.

The standard deduction for married couples filing jointly for tax year 2024 rises to $29,200, an increase of $1,500 from tax year 2023.After the first year, you can amortize the remaining expenses over the next 15 years.But there's another tax break you might be able to claim.

In the u.s., there are seven federal tax brackets.

Last update images today Are Short Courses Tax Deductible

Bonner Scores 24 To Lift Connecticut Sun Past Minnesota Lynx 78-73

TORONTO -- — Mauricio Dubón hit a tiebreaking single in the fifth inning, Jeremy Peña added a solo home run and the Houston Astros beat the Toronto Blue Jays 5-3 on Thursday for their 12th win in 14 games.

"I feel like the team has good vibes right now,” Peña said. “Everyone is showing up with a job to do, which is show up, compete, and win the game. I feel like we’re all on the same page.”

Framber Valdez pitched six innings to win his third straight start as the Astros extended their team-record Fourth of July winning streak to seven.

Yordan Alvarez reached base four times and scored a run as Houston won the four-game series 3-1.

“Our goal is to finish this first half strong and playing our best,” Astros manager Joe Espada said. “I feel like we’re there right now. We came out here and we took care of business.”

The Blue Jays have lost 12 of 16.

“Got to pick yourself up and keep going,” Blue Jays manager John Schneider said. "There’s no giving up, there’s no quitting."

Peña went 2 for 4 with a walk and scored twice. He extended Houston’s lead with a solo homer off Trevor Richards in the seventh inning, his seventh of the season. Peña also homered in Monday’s series opener.

Valdez (7-5) allowed three runs and nine hits. He walked two and struck out four.

“It started not his best but he settled down very nicely,” Espada said.

Tayler Scott pitched the seventh, Ryan Pressley worked the eighth and Josh Hader finished for his 14th save in 15 chances.

Both teams scored three runs in a first inning that produced eight hits and two walks.

Yainer Diaz opened the scoring with a bases-loaded groundout and Jon Singleton followed with a two-run single off Toronto right-hander Chris Bassitt.

Toronto answered with five hits against Valdez in the bottom half. Two runs scored on a bases-loaded single by Spencer Horwitz and Alejandro Kirk added an RBI double.

Peña hit a one-out single in the fifth, advanced on a groundout and scored on Dubón’s single to center.

Bassitt (7-7) allowed four runs and eight hits in five innings to lose for the first time since May 17 against Tampa Bay.

The Blue Jays used a walk and an infield single to put two runners on in the bottom of the fifth, but Astros third baseman Alex Bregman started an inning-ending double play on Danny Jansen’s grounder.

Houston turned five double plays Thursday. Bregman was involved in three, including an unassisted double play to end the first where he caught Ernie Clement’s liner and tagged Horwitz.

“I’ve been playing with him since 2022 and every day on defense he seems to amaze me,” Peña said of Bregman. “He makes plays that I don’t see people make.”

Toronto put the tying run at third base with one out in the sixth but Valdez finished his outing by getting Kirk and Clement to ground out.

The Blue Jays intentionally walked Alvarez to load the bases with two outs in the fourth. Diaz fouled out to end the inning.

“I tell you what, it’s tough to pitch to him right now,” Espada said of Alvarez. “I don’t blame Schneider for intentionally walking him. Right now he’s on fire.”

Alvarez was hit by pitches in the sixth and ninth innings.

ROSTER MOVES

Blue Jays: Jansen was activated off the paternity list and catcher Brian Serven was optioned to Triple-A Buffalo.

TRAINER’S ROOM

Blue Jays: Shortstop Bo Bichette was scratched from the lineup because of a right forearm contusion. The two-time AL hit leader struck out on a pitch that hit him in the arm on Wednesday.

UP NEXT

Astros: Espada said RHP reliever Shawn Dubin will start Friday’s game at Minnesota. RHP Pablo López (8-6, 4.88 ERA) is scheduled for the Twins.

Blue Jays: RHP Kevin Gausman (6-7, 4.75 ERA) is scheduled to start Friday against Mariners RHP Luis Castillo (6-9, 3.87) in the opener of a three-game series at Seattle.

------

AP MLB: https://apnews.com/hub/mlb

Bonner Scores 24 To Lift Connecticut Sun Past Minnesota Lynx 78-73

TORONTO -- — Mauricio Dubón hit a tiebreaking single in the fifth inning, Jeremy Peña added a solo home run and the Houston Astros beat the Toronto Blue Jays 5-3 on Thursday for their 12th win in 14 games.

"I feel like the team has good vibes right now,” Peña said. “Everyone is showing up with a job to do, which is show up, compete, and win the game. I feel like we’re all on the same page.”

Framber Valdez pitched six innings to win his third straight start as the Astros extended their team-record Fourth of July winning streak to seven.

Yordan Alvarez reached base four times and scored a run as Houston won the four-game series 3-1.

“Our goal is to finish this first half strong and playing our best,” Astros manager Joe Espada said. “I feel like we’re there right now. We came out here and we took care of business.”

The Blue Jays have lost 12 of 16.

“Got to pick yourself up and keep going,” Blue Jays manager John Schneider said. "There’s no giving up, there’s no quitting."

Peña went 2 for 4 with a walk and scored twice. He extended Houston’s lead with a solo homer off Trevor Richards in the seventh inning, his seventh of the season. Peña also homered in Monday’s series opener.

Valdez (7-5) allowed three runs and nine hits. He walked two and struck out four.

“It started not his best but he settled down very nicely,” Espada said.

Tayler Scott pitched the seventh, Ryan Pressley worked the eighth and Josh Hader finished for his 14th save in 15 chances.

Both teams scored three runs in a first inning that produced eight hits and two walks.

Yainer Diaz opened the scoring with a bases-loaded groundout and Jon Singleton followed with a two-run single off Toronto right-hander Chris Bassitt.

Toronto answered with five hits against Valdez in the bottom half. Two runs scored on a bases-loaded single by Spencer Horwitz and Alejandro Kirk added an RBI double.

Peña hit a one-out single in the fifth, advanced on a groundout and scored on Dubón’s single to center.

Bassitt (7-7) allowed four runs and eight hits in five innings to lose for the first time since May 17 against Tampa Bay.

The Blue Jays used a walk and an infield single to put two runners on in the bottom of the fifth, but Astros third baseman Alex Bregman started an inning-ending double play on Danny Jansen’s grounder.

Houston turned five double plays Thursday. Bregman was involved in three, including an unassisted double play to end the first where he caught Ernie Clement’s liner and tagged Horwitz.

“I’ve been playing with him since 2022 and every day on defense he seems to amaze me,” Peña said of Bregman. “He makes plays that I don’t see people make.”

Toronto put the tying run at third base with one out in the sixth but Valdez finished his outing by getting Kirk and Clement to ground out.

The Blue Jays intentionally walked Alvarez to load the bases with two outs in the fourth. Diaz fouled out to end the inning.

“I tell you what, it’s tough to pitch to him right now,” Espada said of Alvarez. “I don’t blame Schneider for intentionally walking him. Right now he’s on fire.”

Alvarez was hit by pitches in the sixth and ninth innings.

ROSTER MOVES

Blue Jays: Jansen was activated off the paternity list and catcher Brian Serven was optioned to Triple-A Buffalo.

TRAINER’S ROOM

Blue Jays: Shortstop Bo Bichette was scratched from the lineup because of a right forearm contusion. The two-time AL hit leader struck out on a pitch that hit him in the arm on Wednesday.

UP NEXT

Astros: Espada said RHP reliever Shawn Dubin will start Friday’s game at Minnesota. RHP Pablo López (8-6, 4.88 ERA) is scheduled for the Twins.

Blue Jays: RHP Kevin Gausman (6-7, 4.75 ERA) is scheduled to start Friday against Mariners RHP Luis Castillo (6-9, 3.87) in the opener of a three-game series at Seattle.

------

AP MLB: https://apnews.com/hub/mlb