To claim the home office deduction on their 2021 tax return, taxpayers generally must exclusively and regularly use part of their home or a separate structure on their property as their primary place of business.The simplified option allows qualified taxpayers to calculate the home office deduction at a rate of $5 per square foot for the business use of the home.

Normally, employees pay a tax of 7.65% on their income (fica taxes) and their employers also pay that amount for a combined tax of 15.3%.Beginning in tax year 2013 (returns filed in 2014), taxpayers may use a simplified option when figuring the deduction for business use of their home.Introduction of new categories for home office deductions in 2024.

Involves detailed tracking of all home.Once you know the percentage, you can add up your total eligible expenses and multiply it by that percentage.

In some cases, you may not be able to claim the entire amount of your home office expenses in a single tax year.This simplified option does not change the criteria for who may claim a home office deduction.The credit covers 30% of expenses like:

This means that the maximum deduction a taxpayer can claim using the simplified method is $1,500.This method is much easier to calculate than the standard method and does not require keeping detailed records of all eligible expenses.

As of 2024, there are two methods to calculate your home office deduction:For example, if your office is 250 square feet and your home is 1,000 square feet, you'd deduct 25% of your allowable expenses (250/1,000 = 0.25).Here's an example of how this method works in a real scenario.

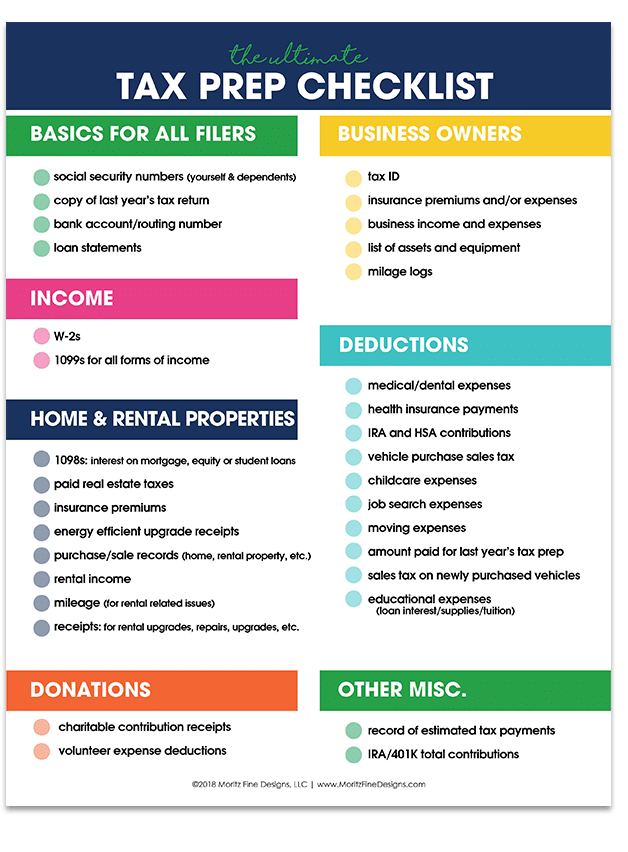

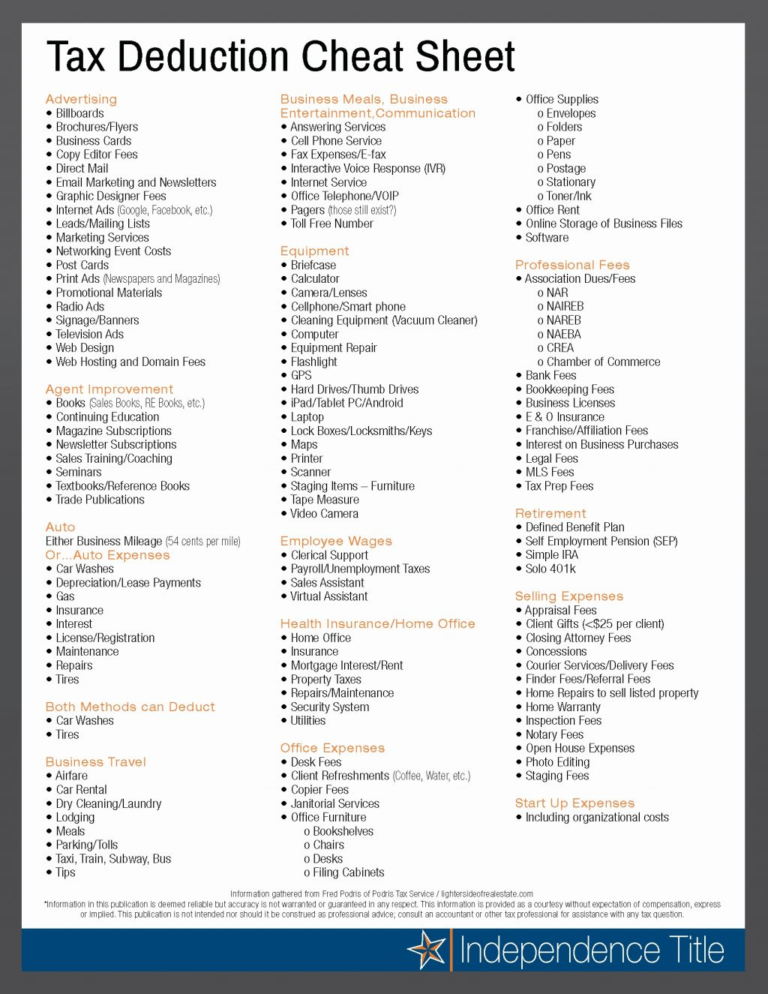

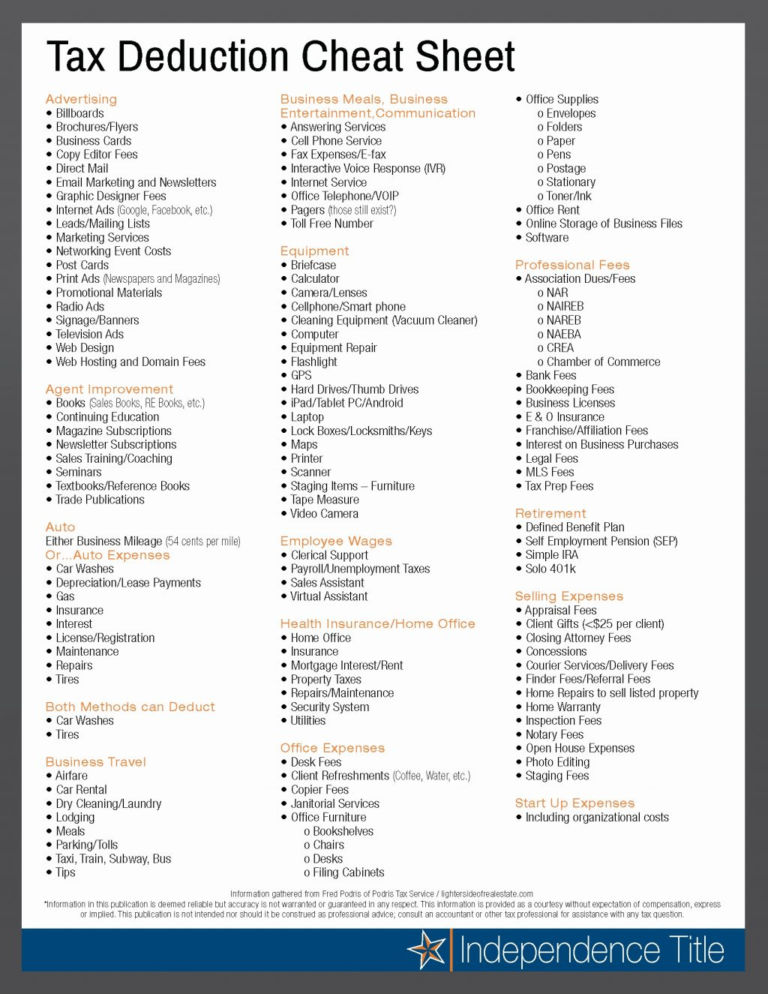

People should understand which credits and deductions they can claim and the records they need to show their eligibility.So if you have $10,000 in total expenses (mortgage interest, real.

Last update images today Common Home Office Tax Deductions

Essex Bring In Bosch For Blast After Sams Ruled Out Through Injury

Essex Bring In Bosch For Blast After Sams Ruled Out Through Injury

Andy Murray's Wimbledon farewell got off to a difficult start on Thursday as he was knocked out of the men's doubles in the first round alongside his older brother Jamie with a 7-6 (6), 6-4 loss to Australian pair Rinky Hijikata and John Peers.

Clearly having his movement limited by back pain, Andy Murray had to rely on his service game as he battled through the straight-sets defeat that potentially leaves him with one match left to play at the tournament.

The two-time Wimbledon singles champion withdrew from his first-round singles match on Tuesday, having not recovered in time from a spinal cyst procedure that left him with reduced feeling in his right leg.

However, Murray's decision to take to the court alongside his brother in the doubles generated considerable excitement at the All England Club as supporters reckoned with the prospect of seeing the British tennis legend compete at the championships for one final time.

The British duo were welcomed onto Centre Court with a standing ovation by a raucous home support for what was the first men's doubles opening-round match to be played on the main show court since 1995.

Having taken the first game with a fierce drive down the middle, Murray first reached for his back at the end of the second. He winced in pain and took every opportunity to stretch his back between points.

Despite his fitness issues, Murray almost secured the first break of the match in the fifth game when a sweet forehand down the line from Hijikata's serve brought up deuce, but the Australians were able to hold.

With a tiebreak needed to separate the two pairs after they traded games, the Murrays let a 6-5 set point lead slip as two high-class shots from Hijikata -- a forehand down the line past Jamie Murray, followed by a volley down the middle -- put the Brits on the back foot.

Centre Court were treated to their first Murray roar of the match as Jamie Murray, a two-time doubles Grand Slam champion, secured the first break of serve by lurching forward to the net and sending back a volley that Hijikata and Peers were unable to reach.

But the Australian duo broke straight back in a seventh game to move into a 4-3 lead that seemed to break the Brits' resolve. And so it proved, as Hijikata and Peers navigated the remaining games to move into the second round at the Murrays' expense.

Asked about his thoughts on playing doubles with his brother, Andy told the BBC, "Yeah it was obviously really special. We never got the chance to do it before. There was a chance this year.

"Jamie's usual partner was playing with Neal Skupski, so he asked me. Obviously it was a bit of a race against time to try and get out here, and physically it wasn't easy today, but I'm glad we were able to get out here and do this one time together."

Andy Murray is due to take to the court again later this week after Wimbledon organizers announced on Wednesday that he had entered the mixed doubles draw alongside fellow Brit Emma Raducanu after the pair were given a wild-card entry. The mixed doubles competition begins on Friday.

Wimbledon will also not be the last time that he will play professional tennis. While Murray has said that he will retire this summer, he is planning to make his final bow at the Paris Olympics, which start later this month at Roland Garros.